The American Empire: The Ruler of the World

Through the dollar, the United States has extended its jurisdiction all over the world. For example, a French bank, in full accord with France's laws, conducted business with countries like Cuba. When the Empire--oops, I mean the U.S.--found out about it, it fined the French bank $9 billion dollars and says if the bank doesn't cough it up it will prohibit the bank from engaging in international transactions using the dollar, which is apparently a power countries have over their currency. Of course, the bank will pay, because how could it stay in business otherwise?

http://www.europac.com/commentaries/nei ... ght_around

EDIT: If you don't like that source, here's Washington Post:

https://www.washingtonpost.com/news/mon ... eir-peril/

_________________

"You have a responsibility to consider all sides of a problem and a responsibility to make a judgment and a responsibility to care for all involved." --Ian Danskin

UN Special Rapporteur says what the U.S. is doing in enforcing its domestic laws extraterritorially is "scandalous":

http://www.plenglish.com/index.php?o=rn ... scandalous

_________________

"You have a responsibility to consider all sides of a problem and a responsibility to make a judgment and a responsibility to care for all involved." --Ian Danskin

androbot01

Veteran

Joined: 17 Sep 2014

Age: 53

Gender: Female

Posts: 6,746

Location: Kingston, Ontario, Canada

Jacoby

Veteran

Joined: 10 Dec 2007

Age: 32

Gender: Male

Posts: 14,284

Location: Permanently banned by power tripping mods lol this forum is trash

Would it bother you less if did it thru the IMF, WTO, the World Bank, or the UN?

If you're afraid of the US exerting it's own laws on other countries then maybe you shouldn't be a big cheerleader for globalism or 'open trade' or whatever you want to call it. Weird place to draw the line now, if you don't like US foreign policy then it seems very odd to support the current world order, now it upsets you that they leverage other countries into doing what they want?

Sudan, for what it is worth, is one of the most irredeemable governments on earth. They are genociders, they are rapists, they gave safe harbor to Osama Bin Laden, they murder and literally enslave Christians to this day so I apologize for not feeling sorry some foreign bank getting fined over doing business with them. The Sudanese government has stolen billions from their own impoverished people, going after their funds they've hidden offshore seems like the least they could do.

The sanctions against Cuba are a unilateral move by the United States. In addition, as the articles made clear, the acts did not violate French or EU law in any of those cases (except falsifying documents, though that was to evade U.S. law):

http://www.economist.com/news/finance-a ... punishment

_________________

"You have a responsibility to consider all sides of a problem and a responsibility to make a judgment and a responsibility to care for all involved." --Ian Danskin

The US is certainly strong enough to be a bully. But, I think it is better if it isn't, as we don't really pay enough attention to know what is really going on outside our hemisphere. And it is debatable as to whether we really pay attention to neighboring countries in our hemisphere. This means we should pay attention to our allies who have a better idea of the consequences of different options that we do.

Agree 100%. I want us to try to fix what's going on in our own backyard, stop trying to become an empire, and adhere better to international norms. We're way past due for that.

_________________

"You have a responsibility to consider all sides of a problem and a responsibility to make a judgment and a responsibility to care for all involved." --Ian Danskin

Agree 100%. I want us to try to fix what's going on in our own backyard, stop trying to become an empire, and adhere better to international norms. We're way past due for that.

A French bank tried to use dollars to do business with states that support terrorism (like Sudan),and with the would be nuclear power Iran. So the US punished them for using our currency to do that.

Why exactly do you have a problem with that?

It may not be our soil, but it is our currency.

And if they wanna do business with those clients all they have to do is use Euros, or Francs, instead.

Agree 100%. I want us to try to fix what's going on in our own backyard, stop trying to become an empire, and adhere better to international norms. We're way past due for that.

A French bank tried to use dollars to do business with states that support terrorism (like Sudan),and with the would be nuclear power Iran. So the US punished them for using our currency to do that.

Why exactly do you have a problem with that?

It may not be our soil, but it is our currency.

And if they wanna do business with those clients all they have to do is use Euros, or Francs, instead.

They also did business with Cuba, against whom the U.S. sanctions are unilateral (and not supported at all by Europe), and the U.S. fined them for that, too.

The problem with your suggestion is that the world is under the post-WW2 Bretton Woods currency system, meaning everything revolves around the dollar. As things stand, using the dollar is inescapable.

This gives the U.S. a lot of power, and it's becoming a lot more aggressive with it, not just here but elsewhere.

_________________

"You have a responsibility to consider all sides of a problem and a responsibility to make a judgment and a responsibility to care for all involved." --Ian Danskin

A lot of people here may question my use of the word "empire". I want to make clear that I use this term to describe what appears to be the overarching goal of several U.S. government policies.

Generally, an "empire" is an entity whose leaders seek to grab resources, as much as they can get, and often see the collection of resources in zero-sum terms; if the other guy gets it, that hurts me, is the attitude. My argument is that USG policy, when you look at the various things it's doing, is to grab as much cash as possible and bring it home while denying it to foreign governments and institutions.

Let's review what the USG has been doing so you can see how it fits:

- The USG institutes citizenship-based taxation, the only country to do so,(1) making its citizens who live abroad pay taxes on their worldwide income. The payment of this income brings cash to the country leaving less cash in the posession of Americans living abroad.

- The USG has been stepping up its collection of taxes via the Foreign Account Tax Compliance Act of 2010 (FATCA), where the USG demands information on clients of foreign financial institutions (FFI), threatening to impose a 30% withholding penalty on dollar transactions which would hurt those institutions because of the role the dollar plays. By gathering information, it can track down the finances of Americans living to bring more cash in than before.

- The USG penalizes the holding of retirement and other investment accounts at FFI by Americans living abroad, even if those FFI are in their country of residence. This has the effect of bringing more cash home, encouraging Americans to invest in U.S. accounts thereby bringing more cash into the country, and denying FFI cash.

- The USG is making the U.S. a tax haven and is impairing the operation of other tax havens through the creation of double standards on disclosure by financial institutions,(2) ensuring that the money, the cash, of tax dodgers flows into U.S. institutions rather than FFI.

- By creating such onerous reporting requirements with such harsh penalties for FFI with FATCA, many FFI have been refusing U.S. clients or anybody who may be a U.S. citizen or green-card holder(3), and it's prevented Americans from getting promotions in companies abroad or entering business partnerships and has created strain for their non-U.S. citizen family members.(4) This makes Americans living abroad more likely to resort to creating accounts with American institutions, thereby denying FFI their business (and their cash) and bringing all the cash home and depositing it in the U.S.

- By raising the fee for relinquishment of citizenship from $0 to $2350 over 2 years (2014-2015) and requiring 5 years of tax compliance and all back taxes paid, the USG ensures that people are either trapped in this situation or have to pay large sums to get out. Either way, more cash flows into American coffers.

Why is the USG suddenly so determined to bring as much cash to the country from abroad, when previously it was largely content with taxes from residents? The answer is obvious: It can no longer remain solvent with the normal residence-based taxation practiced by every other country and which works for other developed countries. We might debate the reasons why, but it is an ominous sign.

Because of the USG trying to grab as much cash as it can at the expense of governments and institutions and people living abroad, it's clear that it's now an empire, and is playing antagonist to the rest of the world. How will the world respond?

------

References:

(1) Mason, Ruth. "Citizenship Taxation". Southern California Law Review Vol 89, pp. 169-240. February 10, 2016. Open access link: https://papers.ssrn.com/sol3/papers.cfm ... wnload=yes

(2) Drucker, Jesse. "The World's Favorite New Tax Haven Is the United States". Bloomberg Businessweek. January 26, 2016 (accessed 10/27/2016). Link: http://www.bloomberg.com/news/articles/ ... ted-states

(3) Newlove, Russell. "Why expat Americans are giving up their passports". BBC News. February 9, 2016 (accessed 10/27/2016). Link: http://www.bbc.com/news/35383435

(4) Hiran, S. Bruce. "Overview of FATCA". taxanalysts.org. August 29, 2016 (accessed 10/27/2016). Link: http://www.taxanalysts.org/content/overview-fatca

_________________

"You have a responsibility to consider all sides of a problem and a responsibility to make a judgment and a responsibility to care for all involved." --Ian Danskin

may I refer you to yanis varoufakis' books, "the global minotaur" and "and the weak suffer what they must", the latter refering to a situation in ancient greece, in which a rich state excerted pressure on a weak island community, which spawned the phrase "the strong do what they can, and the weak..." and so on.

_________________

I can read facial expressions. I did the test.

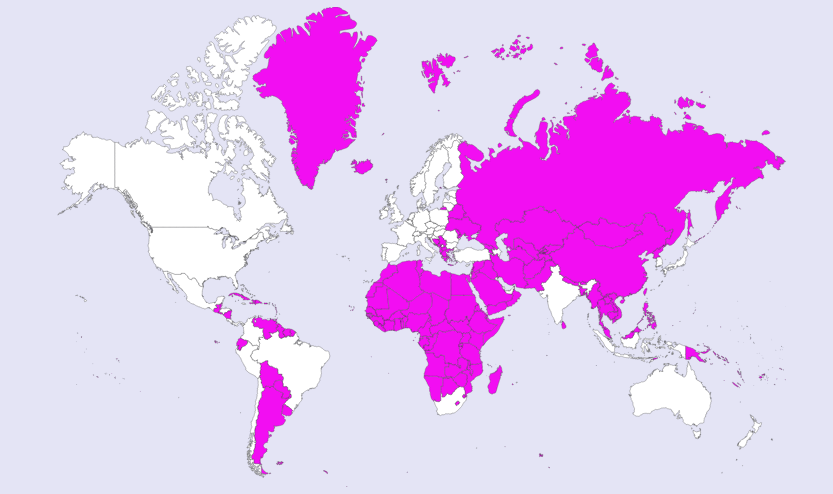

McGill law professor Allison Christians on the imperialism of FATCA, and how it will apply unilaterally to countries not part of intergovernmental agreements because the U.S. "doesn't need them", and so with no way to comply with FATCA they will be shut out of the world financial system:

Prof. Karen Brown wrote an important and influential article in 2002 called Missing Africa on the topic of US tax and trade policy toward developing countries in general, Sub-Saharan Africa in particular. Her article starts with a quote: "We're the... United States. Do we need Africa?"' (from a former World Health Organization official who resigned over the lack of commitment to control AIDS in Africa).

Here the pattern repeats itself: even if they wanted to, many of the countries in the third map cannot forestall the present threat of economic sanctions. The United States simply doesn't need them. Yet many, many of these countries suffer far more from bank secrecy provided by the US and elsewhere than the other way around.

The unjustified and virtually-ignored perfection of US citizenship taxation is one part of FATCA's unexamined legacy, the dismantling of comity in international taxation another; so, too, the repeated exclusion of the developing world from an institutional order that is becoming increasingly unjust.

http://taxpol.blogspot.com/2014/06/the- ... -maps.html

_________________

"You have a responsibility to consider all sides of a problem and a responsibility to make a judgment and a responsibility to care for all involved." --Ian Danskin

| Similar Topics | |

|---|---|

| MT Greene: Rapper Wannabe on American Idol in '02? |

10 Feb 2024, 11:21 am |

| Hello, World! |

Today, 8:29 am |

| Hello, world! |

30 Mar 2024, 8:15 am |

| I don't know where I belong in this world |

30 Mar 2024, 10:02 am |