Running on Empty (The US Empire, the Petrodollar & Ukraine)

Running on Empty

A good series exploring the Petrodollar, the American global financial Empire and its apparent imminent end. TL;DR: Barring something extraordinary, America and its client states in Europe are screwed.

Part I

https://treeofwoe.substack.com/p/runnin ... pty-part-i

How the Petrodollar System Restored, Then Ruined, America's Economy

The second-order effect of the petrodollar system was to flood the US with inexpensive imported goods. As mentioned earlier, when a business sells goods within a country, it is paid for those goods in the country’s currency; and the cost of goods in that currency is based on the value of the currency internationally. The primary way to get US dollars is to sell goods in the US, so everyone in the world suddenly wanted to send us their goods in exchange for our US dollars. And since those dollars were the only way to buy oil, the dollar was strong, meaning the imports were cheap. At the time, this seemed like a remarkably good thing for American consumers — we will send you cheap imports and you will send us pieces of paper you print for free. (Not even pieces of paper — digital zeros in a ledger!)

But it wasn’t actually a good thing. The third-order effect of the petrodollar system was to reduce the demand for exports from the United States. Remember, under the Bretton Woods system, trade with the US had basically worked like this:

Japan (or any other country) sold goods in the US in exchange for US dollars.

The US sold goods in Japan in exchange for Japanese yen.

Japan either redeemed their US dollars for gold from the US, or sold its dollars in exchange for yen. Which of these options its pursued depended on how much yen the US had to exchange, e.g. it depended on US exports to Japan.

Foreign exchange, imports, and exports thus formed a triangle that tended to balance out. (We’re ignoring investment at this time, as foreign investment into the US wasn’t a major factor for the US until after the petrodollar system went into place.) Under the petrodollar system, foreign countries no longer needed to redeem their US dollars for American goods or gold. Instead, they could use them to buy OPEC oil. And they did.

Put another way, before the petrodollar system, the US had to export goods to keep the dollar strong. But the petrodollar system made dollars the only currency capable of purchasing oil, which everyone needed. And so, after the petrodollar system, the US could just export dollars.

The fourth-order effect of the petrodollar system was to financialize and deindustrialize the American economy.

When a country can produce a particular good for export at a lower relative cost than other countries can produce it, that country is said to have a comparative advantage in that good. The petrodollar system gave the US comparative advantage in manufacturing dollars. It could manufacture them at zero cost! No one else could manufacture them at all.

Under conditions of free trade, a country will both produce and export more of the good for which they have a comparative advantage, but will produce less and import more of those goods for which they do not. And that’s exactly what happened in the United States. America produced more dollars and produced much less of everything else.

When I say “produced more dollars,” I mean that literally. When a commercial bank makes a loan, it creates new dollars out of thin air. It manufactures them on demand, like Printful.com but instead of t-shirts, banks make greenbacks. The finance industry was, by far, the biggest beneficiary of the petrodollar system. The manufacturing sector, along with its union workforce, was the biggest victim. The collapse of America’s manufacturing heartland into the wasteland we call the Rust Belt was directly caused and/or exacerbated by the petrodollar system.

So at this point, the US was exporting dollars and importing goods; and Europe and Asia were exporting goods and importing dollars, then spending the dollars to import oil from OPEC members. What were the OPEC members doing with their dollars? Well, some of those big bucks were spent buying M1 Abrams tanks and other expensive products of the US military-industrial complex. (That’s the reason the US can still manufactures guns, missiles, and tanks even though it can’t manufacture diapers or telephones.)

But even the most paranoid sheik only needs a few thousand tanks and fighter jets. The rest of OPEC’s dollars were invested in the United States in a process known as petrodollar recycling. Within 5 years, over $450 billion had been recycled, with 90% of that made by the Arab countries of the Persian Gulf along with Libya. What did they invest in? US government debt. US stocks. US real estate. In short: assets.

Thus the fifth-order effect of the petrodollar system was to create a sustained increase in the price of American bonds, stocks, and real estate. The petrodollar created asset inflation. Banks benefited, as did existing homeowners and investors. The working class felt asset inflation in the form of rising rents.

Viewed as a whole, then, the petrodollar system was incredibly beneficial for (a) commercial banks, (b) arms manufacturers, (c) real estate owners, and (d) stockholders.

For everyone else, the petrodollar system turned out to be a Trojan Horse, a promising gift that destroyed the recipient. By ending the oil crisis and reducing the price of imports, the petrodollar initially seemed to benefit consumers. But in order to consume, consumers needed to have money, and to have money they needed well-paid jobs. By deindustrializing the US, the petrodollar system destroyed the manufacturing jobs that had sustained the working class. In order to maintain their standard of living, US consumers began to borrow money. As their debt rose, though, their position only worsened.

In short, the petrodollar system is directly responsible for almost all of the financial problems that plague the American economy. This is a radical claim, to be sure. To help buttress my theoretical argument, I’m going to close out this essay with some empirical data drawn from a wonderful website called WTF Happened in 1971?.

Part II

https://treeofwoe.substack.com/p/runnin ... ty-part-ii

How the Petrodollar Poisoned Foreign Policy with Financial Profiteering

...

When President Bush ordered the invasion of Iraq in 2003, the war was justified as the necessary disarmament of a destructive supporter of Islamic terrorism and the heroic liberation of a long-suffering people.

At the time, I staunchly supported the war, and even consulted to the Department of Defense for a project during the War on Terror. Unfortunately, I now know that the US invasion of Iraq was more about the petrodollar than about weapons of mass destruction. The evidence was there back then for those with eyes to see. (I didn’t).

On 1 November 2000, America’s Radio Free Europe reported that Iraq was actively attempting to destroy the petrodollar system:

“Iraq is going ahead with its plans to stop using the U.S. dollar in its oil business in spite of warnings the move makes no financial sense… Iraq is dusting off a strategy which another state hit by U.S. sanctions — Iran — discussed as recently as last year… [T]he idea of switching to the euro has appeal to Iran and Iraq because they feel if several major oil producers did it they could create a stampede from the dollar which would weaken Washington.”

Part III

https://treeofwoe.substack.com/p/runnin ... y-part-iii

The Implications of the Petrodollar System for America and World Geostrategy

Conversely, no one can hope to unseat the petrodollar system while these conditions sustain. If 90% of all commerce must cross the ocean, and America controls the ocean, then America controls 90% of all commerce. “The power to destroy a thing is the absolute control over it,” as Frank Herbert so aptly put it in Dune.

To unseat America then, one must wrest from it control over global trade. But does that mean a war for naval supremacy? Not necessarily.

...

After the Cold War, then:

American concluded that maintaining its national hegemony meant it had to forestall the rise of a Eurasian power on the World Island.

Russia concluded that reclaiming its national destiny meant had to again become the leading Eurasian power on the World Island.

These are inherently incompatible foreign policy goals and they have put the two powers back at odds. In the 30 years since the Cold War ended, Russia has systematically worked to rebuild its continental greatness, and the US has systematically worked to keep Russia from doing this.

Russia’s strategic actions have been widely reported in the west, ranging from the 2008 invasion of Georgia to the 2014 conquest of Crimea to the 2022 assault on Ukraine.

Less well reported are America’s operations. The US has expanded the Western sphere of power eastward, bring more nations into the NATO military bloc, the EU economic bloc, and the globalist-progressive cultural bloc. An example of the sort of methods that America uses can be found in this RAND report, Overextending and Unbalancing Russia: Assessing the Impact of Cost-Imposing Options. The 2019 report suggested actions such as:

Undermining Russia’s image abroad would focus on diminishing Russian standing and influence, thus undercutting regime claims of restoring Russia to its former glory. Further sanctions, the removal of Russia from non-UN international forums, and boycotting such events as the World Cup could be implemented by Western states and would damage Russian prestige.

Deploying additional tactical nuclear weapons to locations in Europe and Asia could heighten Russia’s anxiety enough to significantly increase investments in its air defenses.

Providing lethal aid to Ukraine would exploit Russia’s greatest point of external vulnerability. But any increase in U.S. military arms and advice to Ukraine would need to be carefully calibrated to increase the costs to Russia of sustaining its existing commitment without provoking a much wider conflict…

...

What is America’s long term goal vis a vis Russia? I don’t have access to Yankee White security clearance to know for sure — but I’d bet my Substack that our goal is to break the Russian Federation up into a bunch of smaller countries.

That’s not a conspiracy theory; that’s a quote. Secretary of Defense Dick Cheney (later Vice President Cheny, architect of the petrodollar wars of the 2000s) stated he wanted to dismantle not just the Soviet Union but Russia itself, so it “could never again be a threat.” A gaff is when a politician accidentally tells the truth. I believe that policy has been quietly pursued ever since. Journalist Benjamin Norton, writing for Multipolarista, analyzes the situation as follows:

The Russian Federation of today consists of 22 republics. Moscow has long accused Washington of supporting secessionist movements within its borders, aimed at breaking away some of these republics, with the goal of destabilizing and ultimately dismantling Russia. Russian security services have published evidence that the United States supported Chechen separatists in their wars on the central Russian government.

Part IV

https://treeofwoe.substack.com/p/runnin ... ty-part-iv

How the War between Russia and Ukraine is Destroying the Petrodollar System

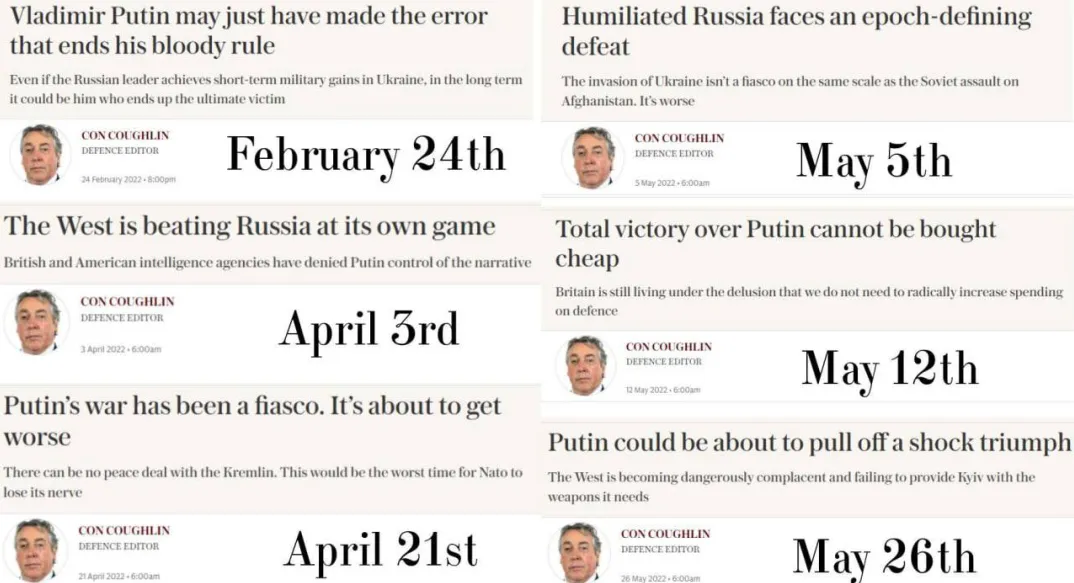

Russia seems to now be on the verge of doing to Ukraine in June what it thought it would do in March — crushing it. Now, it looks like Russia might win in Ukraine after all, and without coming to the negotiating table. The shock this turn of events has caused in our journalist class can be seen by tracing the headlines:

But Putin’s “shock triumph” won’t be the taking of the Donbas. The shock triumph will be the destruction of the petrodollar at the hands of the very sanctions intended to maintain it.

...

On first glance, the Western sanctions seem monolithic and overpowering and the Russian sanctions narrow and weak in comparison. Indeed, the Washington Post called the sanctions a “financial nuclear weapon,” and the unanimous expectation was that Russia would utterly crumble.

Had Russia crumbled, the dollar’s hegemony would have been assured for another generation. A humiliated Russia would have toppled Putin from power and exited Ukraine; the sanctions would have been lifted; Russia would have re-entered the world financial system; and China would have been suitably cautioned not to “f**k around and find out.”

That’s not what happened. As Global Times puts it, “after two months, the effect of the sanctions has failed to meet the expectations set by Western countries. The exchange rate of the Russian ruble has returned to or even exceeded the level before the sanctions, the bank run has basically disappeared, and the performance of the Russian capital market has stabilized.”

The reason the sanctions failed becomes obvious when you look at what didn’t get sanctioned. The EU didn’t ban oil and gas. Instead it just ordered that imports of Russian oil be “phased out” over the next 6 months, with an exception beyond that for EU states that "suffer from a specific dependence on Russian supplies and have no viable alternative options.” The EU has not banned natural gas imports at all. It can’t. Europe has decarbonized and denuclearized so much that it is utterly dependent on Russian power. Russia supplies Europe with 40% of its natural gas. If it does not have Russian gas, Europe freezes.

...

This is a truly seminal moment. Vladimir Putin is essentially the first world leader to defy the petrodollar successfully. Not only is the EU now buying Russian gas in Russian rubles, the rest of the world has largely remained open to trade with the Bear. As it turns out, the “global community” actually only includes the US, UK, EU, Canada, Australia, and New Zealand. Of the world’s 10 most populated countries, only one (the US) joined the sanctions. India, Indonesia, Pakistan, Brazil, Nigeria, Bangladesh, and Mexico did not.

_________________

Behold! we are not bound for ever to the circles of the world, and beyond them is more than memory, Farewell!

There's enough nonsense in the early bits of this that I'm not going to bother with the later bits.

Firstly, the "petrodollar" is something of a myth. There's nothing to stop anyone buying or selling oil in other currencies, and indeed many do. Dollars are the primary currency of international trade because they are the currency that everyone wants (they're fluid and relatively secure), not because of some cabal artificially inflating demand or because the US threatens anyone who goes against it.

Secondly, there is no international comparison. For example, the consensus is that the collapse in manufacturing in the US is because of economic transition and the US not being able to compete with countries with lower costs. If USD becoming the global reserve currency caused the collapse in US manufacturing, we would expect there to be no comparable collapse in countries in similar economic places but not using USD as their currency. What happened to manufacturing in the UK, or France, or Canada?

Thirdly, related, there is no reference to the existing literature. The author makes a lot of claims about the world, but does not explain how he came to those conclusions. He doesn't cite his sources for most of his claims. How do we know he hasn't just made it all up?

I would immediately set my sights on free trade policies of course, arguable the other side of the same coin.

Whatever angle you take on the petrodollar, conspiratorial or not, it doesn't change the fact that the U.S. is highly vulnerable to serious currency competition, losing reserve status would be devastating to the U.S. economy and its foreign policy has undoubtedly been influenced by it in recent decades. This is not, by the way, what has driven U.S. hostility towards Russia since the fall of the Soviet Union. That's more boring we-must-control-Eurasia geopolitics - much less controversial, because unlike the murky world of the petrodollar and the Saudi alliance - they often come right out and say it from time to time. It's the shadow war on Russia which has resulted in the hot war in Ukraine, which has resulted in a looming bifurcation of the world economy and undermined the global system of trade and finance on which the U.S. relies to fund its deficits.

Edit: this is a fairly balanced and, naturally, inconclusive read on the petrodollar: https://www.energyhistory.eu/en/special ... onnections

_________________

Behold! we are not bound for ever to the circles of the world, and beyond them is more than memory, Farewell!

Last edited by Mikah on 18 Jun 2022, 5:02 pm, edited 1 time in total.

By that logic, what does it mean that Putin, in response to sanctions on banking, is now asking Europe to buy fossil fuels in Rubles - I mean, apart from the fact that it successfully held the Ruble afloat and prohibited the total inflationary collapse of the currency.

Wouldn't the text imply that that's a massive win for Putin, unless, of course, Russia can be destabilized to a breaking point, and USD reinstated?

_________________

I can read facial expressions. I did the test.

Exclusive: Saudi Arabia threatens to ditch dollar oil trades to stop 'NOPEC' - sources

They said the option had been discussed internally by senior Saudi energy officials in recent months. Two of the sources said the plan had been discussed with OPEC members and one source briefed on Saudi oil policy said Riyadh had also communicated the threat to senior U.S. energy officials.

...

A move by Saudi Arabia to ditch the dollar would resonate well with big non-OPEC oil producers such as Russia as well as major consumers China and the European Union, which have been calling for moves to diversify global trade away from the dollar to dilute U.S. influence over the world economy.

...

Saudi Arabia controls a 10th of global oil production, roughly on par with its main rivals - the United States and Russia. Its oil firm Saudi Aramco holds the crown of the world’s biggest oil exporter with sales of $356 billion last year.

Depending on prices, oil is estimated to represent 2 percent to 3 percent of global gross domestic product. At the current price of $70 per barrel, the annual value of global oil output is $2.5 trillion.

Not all of those oil volumes are traded in the U.S. currency but at least 60 percent is traded via tankers and international pipelines with the majority of those deals done in dollars.

Note: I would say that this is indeed a saying used by all political factions in China. At least those with enough influence to be noticed by me.

_________________

With the help of translation software.

Cover your eyes, if you like. It will serve no purpose.

You might expect to be able to crush them in your hand, into wolf-bone fragments.

I would say that the whole chain is actually something that has been analyzed in China's political debate to be so boring that it becomes a prerequisite for other discussions.

In summary:

The world trades in dollars, and every time the United States is responsible for one of the financial crises, it can print dollars indefinitely to obtain the income of its debtor countries. This usually means a worse working environment and housing prices in China / Japan.

At least I have observed that the Chinese government has carefully controlled the U.S. debt at a low level in the past five years - too little U.S. debt leads to huge fluctuations in the exchange rate of its own currency, while more U.S. debt can easily lead to the harvesting of debt holding countries by the United States.

We are not quite sure which level of the US is to blame - but the main body of expression is the Federal Reserve.

The loss of global military hegemony by the United States will end this system - and thus become a fairer multipolar world. This depends on military power that can be checked and balanced. Otherwise, the corresponding countries have to say hello to "democracy".

The prospect of having to compete fairly with other countries has caused a systematic scream of incitement from a certain level in the United States.

_________________

With the help of translation software.

Cover your eyes, if you like. It will serve no purpose.

You might expect to be able to crush them in your hand, into wolf-bone fragments.

| Similar Topics | |

|---|---|

| Mexico City may be months away from running out of water |

25 Feb 2024, 11:55 pm |

| Putin Admits He Invaded Ukraine "to impress Jodie Foster" |

02 Apr 2024, 2:48 pm |