GOP tax scam

auntblabby

Veteran

Joined: 12 Feb 2010

Gender: Male

Posts: 113,697

Location: the island of defective toy santas

now that our congress of sociopaths have rammed through their latest "trickle down" nonsense that throws a crumb or two at the upper part of the 99% but takes them away in 2025, and given corporations a big tax cut that is PERMANENT, what say all you who think trickle down [supply side economics] actually works and isn't just smoke and mirrors? when the GOP asked corporations what they intended to do with their new gift, the bulk of them said they'd give it back to shareholders in the form of stock buy-backs, otherwise they'd just sit on it. a similar one-time "tax holiday" on overseas profits generated little economic oomph 13 years ago. The 2004 American Jobs Creation Act temporarily cut taxes on repatriated profits to 5.25 percent from 35 percent. About 9,700 companies took advantage of the tax break, bringing back $312 billion. Fifteen companies, led by Pfizer, Merck and Hewlett-Packard, accounted for 52 percent of the repatriated money. A 2011 Congressional Research Service report found that the tax holiday "did not increase domestic investment or employment." Instead of expanding operations or hiring, companies tended to use the money to buy back shares of their own stock — purchases that disproportionately benefit wealthy investors, who are less likely to spend any extra income.

"It has almost no payoff to the economy," says Adam Looney, senior fellow in economic studies at the Brookings Institution.

https://www.cbsnews.com/news/gop-tax-pl ... -not-work/

do not believe they will give out raises to their rank and file work force, or hire any more American workers, they never have in previous iterations of this type of tax break.

trickle down is just a fairy tale, and cutting taxes while boosting military spending is a recipe for ballooning the national debt. tax attorneys are just laughing all the way to the bank while the GOPTPers "starve the beast." WE, the 99%, are that beast they wanna starve to death, btw.

After all this time, and multiple countries conned, there seems to be no evidence that trickle down theory worked anywhere at any time. Friedmanite theory led to the rich getting richer in every country that applied it, including New Zealand, and very substantially so. "There is no alternative" and the level playing ground never existed at all except in fairy tales, as the Friedmanites knew all along, despite their Barnum and Bailey propaganda.

Reich captures it in a few lines:

https://www.facebook.com/RBReich/?hc_re ... d8&fref=nf

My inner geek likes to know what I'm dealing with, especially when I have no ability to alter it. So here are some useful links to hopefully useful info. (Don't misunderstand: this isn't an indication that I approve. I absolutely do not. Everything about this mess is and was and will always be absolutely shameful. But it's easier to prepare for the worst when you have some ability to predict it.)

Online tax estimator from MarketWatch: https://www.marketwatch.com/story/the-n ... 2017-10-26

Income brackets before and after the change: https://www.thebalance.com/trump-s-tax- ... ou-4113968

A caveat for retirees and anyone else on Social Security from Motley Fool: https://www.fool.com/retirement/2017/12 ... ients.aspx

Finally, national and state-by-state estimates of the tax plan's impact, when it first goes into effect, and ten years from today: https://itep.org/finalgop-trumpbill/

_________________

"I believe you find life such a problem because you think there are the good people and the bad people," said the man. "You're wrong, of course. There are, always and only, the bad people, but some of them are on opposite sides."

-- Terry Pratchett, Guards! Guards!

auntblabby

Veteran

Joined: 12 Feb 2010

Gender: Male

Posts: 113,697

Location: the island of defective toy santas

Online tax estimator from MarketWatch: https://www.marketwatch.com/story/the-n ... 2017-10-26

Income brackets before and after the change: https://www.thebalance.com/trump-s-tax- ... ou-4113968

A caveat for retirees and anyone else on Social Security from Motley Fool: https://www.fool.com/retirement/2017/12 ... ients.aspx

Finally, national and state-by-state estimates of the tax plan's impact, when it first goes into effect, and ten years from today: https://itep.org/finalgop-trumpbill/

What I want to know, without having to try figuring all that out is, will people who make between $25,000 and $50,000 be paying more income tax or less income tax in 2019?

auntblabby

Veteran

Joined: 12 Feb 2010

Gender: Male

Posts: 113,697

Location: the island of defective toy santas

Online tax estimator from MarketWatch: https://www.marketwatch.com/story/the-n ... 2017-10-26

Income brackets before and after the change: https://www.thebalance.com/trump-s-tax- ... ou-4113968

A caveat for retirees and anyone else on Social Security from Motley Fool: https://www.fool.com/retirement/2017/12 ... ients.aspx

Finally, national and state-by-state estimates of the tax plan's impact, when it first goes into effect, and ten years from today: https://itep.org/finalgop-trumpbill/

What I want to know, without having to try figuring all that out is, will people who make between $25,000 and $50,000 be paying more income tax or less income tax in 2019?

some will be paying more, the site I clicked on didn't say what the specific individual cases were. I myself am paying .9% more [.9% higher tax rate] than last year.

Online tax estimator from MarketWatch: https://www.marketwatch.com/story/the-n ... 2017-10-26

Income brackets before and after the change: https://www.thebalance.com/trump-s-tax- ... ou-4113968

A caveat for retirees and anyone else on Social Security from Motley Fool: https://www.fool.com/retirement/2017/12 ... ients.aspx

Finally, national and state-by-state estimates of the tax plan's impact, when it first goes into effect, and ten years from today: https://itep.org/finalgop-trumpbill/

What I want to know, without having to try figuring all that out is, will people who make between $25,000 and $50,000 be paying more income tax or less income tax in 2019?

some will be paying more, the site I clicked on didn't say what the specific individual cases were. I myself am paying .9% more [.9% higher tax rate] than last year.

Well then his tax cut sucks.

The tax cuts may be used as a "reason" next year to further contract social services to those who need them most. The needy people who believed Trump would look after the "little guy" may end up the biggest losers and it is a danger to which they were and still seem to be blind. Trump is not their friend, and he never was, he exploited their gullibility and the outcomes may be quite tragic in a year's time.

And *there* is the danger of personality cults in politics. It's no accident that US public schools stopped teaching rhetoric, critical thinking, and even civics decades ago. It's also no accident that the US public education system has been systematically undermined by one political party for at least the same length of time. Thinking adults won't stand for this stuff, so the obvious solution is to cripple their thinking (edit in: and keep them infantile) - substitute sound and fury for observation and analysis, and push laziness, mental and spiritual, as desirable character. You end up with a population that is indifferent to corruption because, if they can think at all, they think they personally will benefit from it - their idols tell them so.

Right out of the authoritarian-wannabe's playbook. Orwell and others saw it in their time, but it takes both intelligence and detachment - a willingness to face unattractive facts about one's own nation/people/politics/opinions - for us to heed their warnings. Even then, if all we do is the slow headshake with tut-tut (which is the other party's specialty), nothing improves.

_________________

"I believe you find life such a problem because you think there are the good people and the bad people," said the man. "You're wrong, of course. There are, always and only, the bad people, but some of them are on opposite sides."

-- Terry Pratchett, Guards! Guards!

auntblabby

Veteran

Joined: 12 Feb 2010

Gender: Male

Posts: 113,697

Location: the island of defective toy santas

Kraichgauer

Veteran

Joined: 12 Apr 2010

Gender: Male

Posts: 47,782

Location: Spokane area, Washington state.

kokopelli

Veteran

Joined: 27 Nov 2017

Gender: Male

Posts: 3,657

Location: amid the sunlight and the dust and the wind

Whether reducing tax rates results in more tax revenue is not always clear. Many people seem to think that it always happens, but they are completely ignoring the reasons.

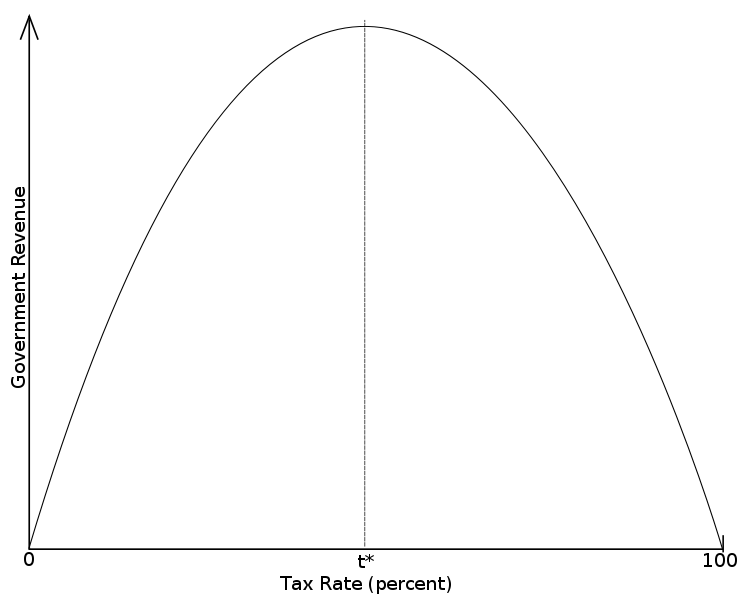

It all goes back to the Laffer Curve. The Laffer Curve is a curve of tax revenue raised for each tax rate.

If the tax rate is zero, then no tax revenue is raised. Thus, it starts with tax revenue of $0. If the tax rate is 100% then there is no reason to work so the tax revenue would be $0.

Between the two, the tax received will climb as the tax rate increases up to the point that too many people forgo additional income from working extra because the taxes are too high. Naturally, this is different for many different people.

The peak of the Laffer Curve is the tax revenue raised at the tax rate that produces the most revenue. If the tax rate is above that rate, then raising taxes will result in less revenue. If you want more tax revenue, you have to lower the tax rate.

Similarly, if the tax rate is below that peak rate, then by increasing taxes you would increase tax revenue.

To far too many Reporkians, the estimated peak is always below the current tax rate and thus you can increase tax revenue by reducing taxes. While the Demoporks are seldom right, they are right when they say that decreasing the tax rate will decrease tax revenue.

The real lesson to learn from this is that the Laffer Curve is all about big government and maximizing tax revenue to pay for that big government. If you are in favor of small, limited government, you want the tax rate to be decidedly before the maximum and the government to spend only what they bring in revenue to pay for.

auntblabby

Veteran

Joined: 12 Feb 2010

Gender: Male

Posts: 113,697

Location: the island of defective toy santas

goldfish21

Veteran

Joined: 17 Feb 2013

Age: 41

Gender: Male

Posts: 22,612

Location: Vancouver, BC, Canada

One figure I've seen in headlines repeatedly is that by 2027 those earning $75K or less will pay higher taxes than now.

Sooo that may mean that between now & then, they pay less. That's 10 years. That's more than enough time for Trump to have his two terms.. and he might just get it if enough people get a few extra dollars. Scary thought.

_________________

No

auntblabby

Veteran

Joined: 12 Feb 2010

Gender: Male

Posts: 113,697

Location: the island of defective toy santas

What I want to know is when will I get my Universal Basic Income?

Trickle Down has never worked in the past, but yet it gets votes again and again because the big companies put people in office, and it's payback. Politicians make out that they are public servants but it always ends up with "You scratch my back, I'll put a knife in yours".

_________________

Diagnosed with Autism on 1st August 2018, at the age of 47 (almost 48).