Quote:

Federal, state and local income taxes consumed 9.2% of all personal income in 2009, the lowest rate since 1950, the Bureau of Economic Analysis reports. That rate is far below the historic average of 12% for the last half-century. The overall tax burden hit bottom in December at 8.8.% of income before rising slightly in the first three months of 2010.

"The idea that taxes are high right now is pretty much nuts," says Michael Ettlinger, head of economic policy at the liberal Center for American Progress

Then another story in 2011:

Quote:

The total tax burden — for all federal, state and local taxes — dropped to 23.6% of income in the first quarter, according to Bureau of Economic Analysis data.

By contrast, individuals spent roughly 27% of income on taxes in the 1970s, 1980s and the 1990s — a rate that would mean $500 billion of extra taxes annually today, one-third of the estimated $1.5 trillion federal deficit this year.

The Bush and Reagan tax cuts were real. It's not a conspiracy of historians. Credits have also been added and extended. Capital gains taxes are also low right now. Something that Warren Buffet has been talking about. The CBO, Buffet, Greenspan and even Reagan's former budget director David Stockman are all noting that we are paying too little in taxes right now. It's silly. You can't live on your grandchildren's tax base and call it principled. The bills are very real.

http://www.usatoday.com/money/perfi/tax ... -low_n.htmhttp://www.politifact.com/truth-o-meter ... 50s-ceos-/Quote:

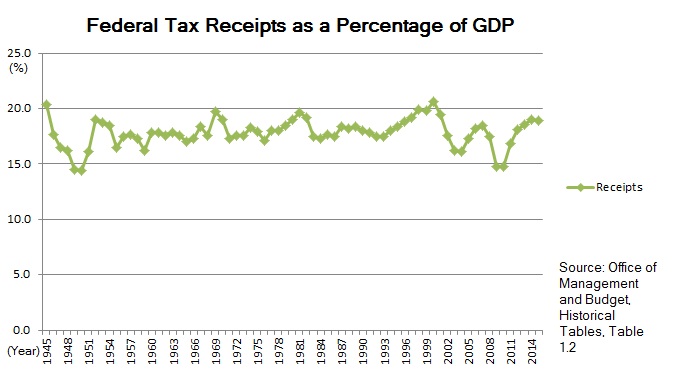

Looks about the same

Your charts are quite different. Look at the ends. One shows tax revenue heading down, one heading up. That's because one OMB chart is a projection of what will happen through 2017 after the Bush cuts expire (as legally they are set to do this year). The CBO has similar charts. They have to assume the law is the law and will expire as intended.

So as evidence that taxes are high you are using future projections of what things might look like if the Bush cuts expire (and the economy recovers). That's silly. Setting aside that they won't likely expire as intended and there will be another deal. If they don't expire at some point we are in big trouble, as CBO points out.